Who are Angel investors or Seed investors | How to find an Angel investor

When starting a new startup, One of the biggest problems to come is 'No funding'. Idea without funding makes everything go waste.

Often, to find funding for a startup, one have to work very hard.

If you are doing a business or do you think of doing business in the future or even if you have a startup idea, then this is really important for you to understand ANGEL INVESTORS.

Who are Angel investors?

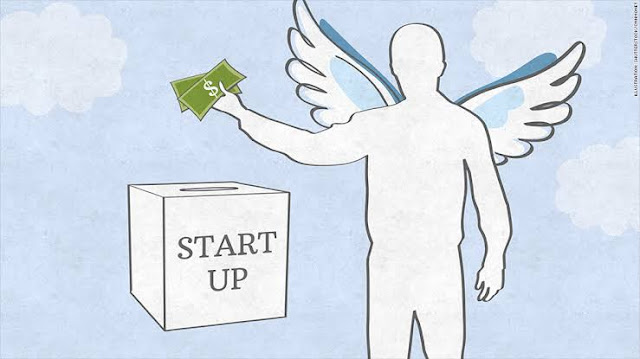

An angel investor is a person who funds a Startup company or an entrepreneur in an early stage of the Business as financial backing in return of some share in the company.

They help small startups financially.

For example: pretend this is you. Having a great Startup idea and planning for making your idea into a reality.

An invester will help you financially.

As in their name, they are investors for early stage business. They are not less than any angel because they fund you at very crucial period.

You will need finding for your recently started business. And when you need money the most and when it's not easy for you to arrange money.

Because your business is new and on a new player no one wants to make a big claim. So in the early days of a newly formed Business it is really hard to get funds. And at that time the angle investor is the one who is ready to fund your business.

An estimate is that in the United States during the last two years there about 3 lakh investors have invested as angel investors.

Likewise in India, here also many angel investors are there.

Investors have invested about $7.8 billion in the first four months of 2021, which is almost 70% of the overall corpus of $12.1 billion funded in entire 2020 and more than 50% of $14.2 billion raised in 2019.

But the question arises, How to reach them? We will see how to reach an angel investor but before that you need to know that there may be advantages or disadvantages?

Angel Investors are such individuals, who are very strong financially. So they help startups with their own money and in turn they take partnership in those startups.

What are the advantages and disadvantages of funding.

First, let's see:

Advantages of Angel investors

1. Funding

Investments are done in the name of angel investor is an advantage in the form of funding, But instead of Angel Investor, a loan can also be taken from bank.

What is the difference between the two. Is that if you take a loan from the bank, you have to repay that loan, whether it starts sinking or succeeds.

The bank will not make any sense, whether your startup has performed well or poorly. But this is not the case with Angel investor. If an Angel Investor Invests has invested in Your Business then he is one in your company. Becomes the share of the targeted percentage, that even if your company benefits or there is a loss. You don't have to pay.

2. Business Advise

This advantage is often ignored but if you have an Angel Investor with you, who invests in your startup. Firstly, that means he has seen a potential in your business and investing on your potential. Second thing is that, if you have a partner like Angel investor, he can also help you a lot in business.

We need advice at almost every step in business. Angel Investor him/herself is an experienced person who never wants their money to sink. So it will help your business as well and they will give necessary advice.

Now let's discuss about,

Disadvantages of Angel Investors

1. Control Lost

This is the advantage of being an angel investor that you need not have to return the funding. So you don't have to worry if something goes bad, It's not a loan.

Instead you give them a stake in your company, but this stake can also be a big loss. When you give someone else a stake in your company, that means you handed over the command of your company to someone else.

If understood in easy language, you alone can't decide what you want for your company. As long as your partner Angel Investor do not support your decision.

2. Profit Sharing

This has been seen in many cases that Angel Investors who invest now. After ten years, for the benefit of the company that looks very small infront of it.

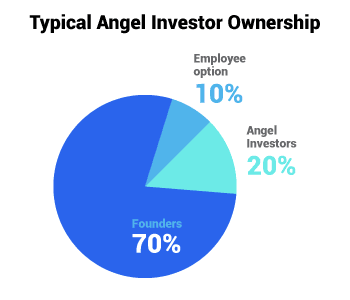

Suppose for example, You started a business for 3 lakh rupees and your Angel Investor is investing for a stake of 33% and gave you a funding of 1 lakh rupees.

Assume that your profits after 10 years are 3 million per year. And now to angel investor who is also your partner and owns your company at 33%. A share of about 10 lakhs is being given.

So, here if you took 1 lakh rupees from the bank Instead then maybe you have got such a big part of your profit. And you don't have to give any profit shares to someone.

3. Risk of idea taken by the angel investors

Like coins have two faces or two sides. Similarly, this thing also has two sides. One is right and another one is wrong.

Whenever we give stake of our company to an angel investor. In future when your Startup might be in a bad phase, the same investors have to sell their shares. Who initially invested in your startup.

The reason behind this is that in the future if your business could not succeed due to some reason, then they have only one option available. They sell their stake to another angle investor.

But, because you don't have enough capital for you to buy another partner's stake, It will be difficult and then even if you don't want to stake to another angle investor.

If you want learn more about how to get profit from early stage investment in your startup and how to use that investment to get best out of it.

I would recommend this books, which are best if you want to become an entrepreneur or grow your Startup.

If you want to get funding from angel investor. So let's know,

How to find Angel Investors?

Make an online presence of your startup on social media and on web to get noticed by angel investors. Make a detailed and well established portfolio for your brand on your website, then use social media platforms to find and reach out to them and present your Startup or idea.

To get an angel investor which requirement should be fulfilled?

An Angel Investor always invest in Startups in the early stage of Startups. But they take special care of MVP. If you entered into this Startup Culture, You may have noticed or have business sense. Then you must know what is this MVP?

Even if you don't know, understand it in an easy language that whenever a company makes a product. They takes feedback of your initial product, their MVP then becomes Minimum Viable Product.

The better it is the more Satisfied the customer is. Angel Investors take care of this things.

How is the MVP for your Start Up?

If your MVP is not very good, So you can have Angel Investors near you. Try to find such as individuals which belongs to your family or local and you know in your life or who are investing on a company.

And you have already invested on some of your products. But if your MVP is good and has crossed the finishing line then you can get out of this circle.

If your MVP has crossed the finishing line, then make a list of such individuals those who want to invest. If you want information, details and list of angel investors, you can also take help of social media. Social media platforms such as LinkedIn, Facebook, twitter etc.

When you will get a list and details about angel investors. So contact them and fix a meeting with them. And before going to that meeting to convince potential investor keep some things in mind. Such as, The first thing is that your company's Motive should be very clear and the Elevator Pitch must be perfectly clean.

But do you know,

what is an elevator pitch?

Elevator pitch is a short description of your idea, product or company which in the shortest words to explain to an angel investor. A short and detailed description is the key to win angel investors.

So, keep it super simple to understand.

- The Second thing you should do is to explain the whole concept then while preparing for the meeting, keep this in mind. That your product should be solid, In your MVP meeting it will be used to pull investors.

But after that, your MVP will not work. A demo of your product will work. The more solid the product, the better the impression.

Keep in mind that the demo shows your potential, So if you don't demo you are not showing your potential.

- The third thing you have to keep in mind is that you should know that your product is in such a big competition. And how to make room in such a big market is how different and better your product is from competing products.

Or if you are offering services, how are they better than others.

- The fourth thing you have to keep in mind is that is about funding. How much funding will you need and how are you going to use it.

And what will you offer in return. Your point of view must be very clear-cut and must represent without any misunderstanding, without any confusion.

Take care of these four things!

When an Angel Investor is ready to invest on your Idea and your Product. The Angel Investor or Investor's Groups they definitely want to get good results from there.

When you are running a startup at an early stage, then any amount is very valuable for you.

But Friends, don't just only run after taking money.

Can you work full time and start a business at same time?

Before that do ask yourself some things, like: If you're seriously willing to and passionate about your work and leave your daily job.

Because startup itself is like a full time job and it is very difficult to continue with the job.

And lastly, Whether you are ready to share ownership of your startup with someone else on the future?

So after knowing this all, You must have understood that angel investor can play very important role in your startup.

If you too are looking for funding for any of your business. You should always keep in mind, all the things mentioned in this page.

And if this information helped you please let us know in the comments.

3 comments

I am glad it helped you.

Thanks

JAI HIND